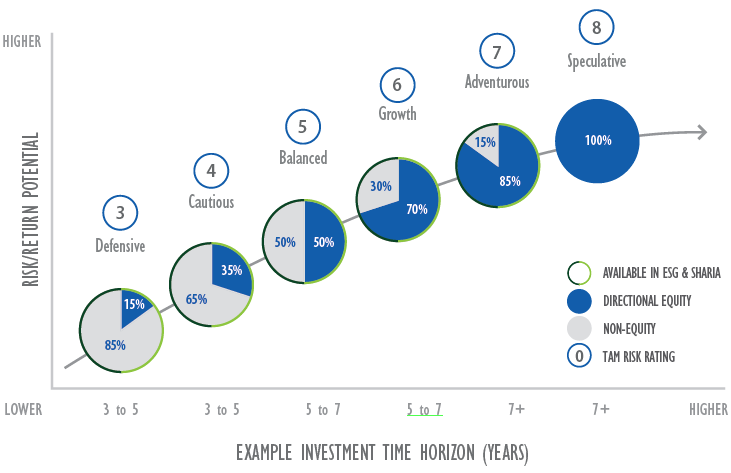

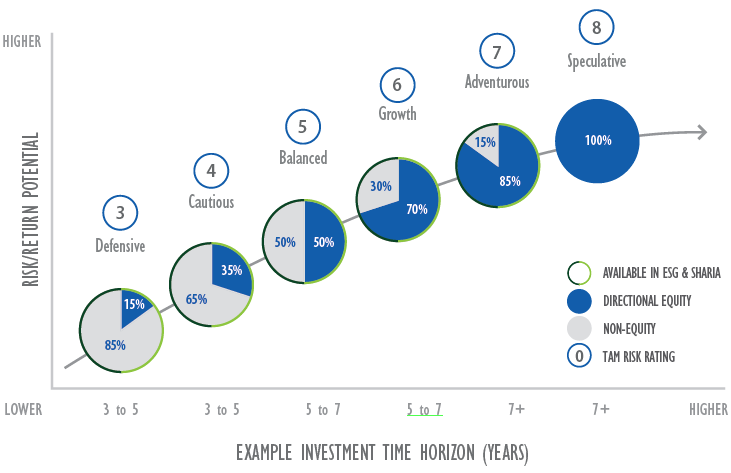

Defensive

Active Defensive seeks to generate modest returns higher than cash in the bank over the medium term with potential for consistent though constrained capital growth. The portfolio has a more defensive approach to equity exposure compared to Active Cautious - typically comprising of 15% equity and 85% non-equity - though weightings may deviate within set parameters, allowing our managers to react to market conditions.

Cautious

Active Cautious seeks to generate modest capital growth higher than bond based returns over the short to medium term by employing a more cautious investment strategy than Active Balanced. The portfolio will have a modest approach to equity exposure - typically comprising of 35% equity and 65% non-equity - though weightings may deviate within set parameters, allowing our managers to react to market conditions.

Balanced

Active Balanced seeks to generate capital growth over the medium to longer term, with the aim of riding out short-term fluctuations in value. The portfolio will have a more balanced approach to equity exposure compared to Active Growth - typically comprising of 50% equity and 50% non-equity - though weightings may deviate within set parameters, allowing managers to react to market conditions.

Growth Active Growth seeks to generate higher capital growth over the medium to long-term by employing a more dynamic investment strategy. The portfolio will have a higher exposure to equities compared to Premier Balanced - typically comprising of 70% equity and 30% non-equity - though weightings may deviate within set parameters, allowing managers to react to market conditions.

Adventurous

Active Adventurous seeks to generate strong capital growth over the longer term and can experience potentially frequent and higher levels of volatility than Premier Growth. The portfolio will have a large exposure to equities - typically comprising of 85% equity and 15% non-equity - though weightings may deviate within set parameters, allowing managers to react to market conditions.

Speculative

Exclusively available to our Active clients, Active Speculative seeks to generate aggressive capital growth over the longer term and can experience very high levels of volatility in both the short and longer term. The portfolio will have a much higher high exposure to equities compared to Active Adventurous - potentially comprising of 100% equity - though weightings may deviate within set parameters, allowing managers to react to market conditions.

Each of our model portfolios is risk profiled so you can intuitively know which is appropriate to meet your clients investment objectives. Models can be combined in a single portfolio and risk profiles changed during the life cycle of clients investment.

Source: TAM Asset management International Limited. The value of investments, and the income from them, may go down as well as up and may fall below the amount initially invested. Weightings may deviate from these levels at the Investment Team's discretion, whilst staying within specific guidelines.