Markets never cease to amaze, and as COVID ravages the world on its second coming, we also have the US democracy under pressure from Trump supporters as they created mayhem in the city of Washington and forced impeachment proceedings.

Markets appear unperturbed and indeed the UK has begun with its best investment returns in the first week or so ever recorded. This is in an environment in which the UK is still disentangling from the EU as Brexit is finally implemented. Clarity is often all markets need and Brexit, good or bad, is here, so let’s move on. The US has likewise moved higher but as has been highlighted previously, there are not so subtle shifts going on in market leaders and laggards.

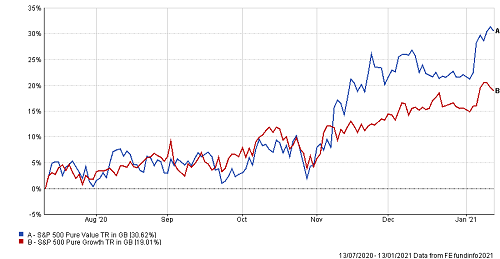

The bulk of 2020 broadly was characterised by gains in ‘growth’ - tech, healthcare and similar stocks known as the ‘stay at home stocks’. These sectors made extraordinary gains as the rest of the world faltered under the pressure of COVID’s impact on corporate earnings.

Growth and tech led the way and just did not stop, until that is, the first initial positive announcements on vaccine potential, then the investment world spun on its axis. Growth and tech crumbled and in November 2020 with markets making unprecedented leaps, it was the old fashioned ‘value’ positions that made all the headlines and all the gains. Growth bulls deem them unjustified and maybe that’s possible… I personally don’t think so!

Many commentators favour the idea that big tech was just in the shadows short term. Having made so much money in 2020 it’s easy to afford a quarter of solid underperformance after all, isn’t it?

Pure Value vs Pure Growth

Pricing Spread: Bid-Bid ● Data Frequency: Daily ● Currency: Pounds Sterling

Source: FE Analytics

The more likely situation is that markets are in change, something that TAM discussed was likely from mid-2020.

In the third quarter we saw massive up moves in what were value ‘back to work’ stocks as a whole. In 2021 that area has not retreated, although there are still the odd days where growth bulls take hold. In early 2021 banks, oils, consumption, infrastructure and many an old fashioned play has driven markets higher - value is not giving up easily and nor will it.

We are neither a growth bear nor a value bull, but markets are never forever. A strategy, an investment approach, a technical or risk analysis can all be shot in the foot for periods (and quite substantial ones) as markets digest new information.

What are thought of as unfashionable sectors can outperform for months and months at a time (dare I say years), to the extent that they become an embarrassment to portfolio managers who don’t embrace efficient diversification.

We have been driven for years by growth but don’t fall in love with that. Portfolio diversification is essential to ensure steady returns. It is my opinion that markets will of course fluctuate twixt growth (stay at home stocks) and value (back to work stocks) but that the latter will be the dominant return factor from September 2020 through to at least March 2022.

Don’t fight the tape, and remember investments which are ‘very strong’ that become ‘quite strong’, become a disappointment when something which is ‘awful’ that becomes ‘quite poor’ attracts optimistic attention.

We therefore believe that there certainly is value in diversification, and that this will be absolutely key in 2021.

If you would like to discuss our portfolios or current positioning further please do not hesitate to contact me.

Phil Hadley

Email: phadley@tamint.com

TAM Asset Management International

DOWNLOAD THE

January 2021 INVESTMENT NOTE

The Value in Diversification

The Value in Diversification