The policy options on both sides are running out.

As the Greek debt crisis enters a crucial phase, speculation over whether a solution is even possible is leading to greater volatility in stock and bond markets. Predicting how the end game plays out is guesswork hinging as it does entirely on the policy decisions of the IMF, EU,ECB and the Greek Government. A way out of the default scenario may be possible but will require remarkably courageous political decisions which have eluded the various parties thus far.

Since the first €110 billion bail-out in May 2009 it been the problem that won’t go away, repeatedly returning to haunt global markets. The new popular analogy is of the Greek Government, EU, IMF and ECB “kicking the can down the road” rather than dealing with the issue once and for all. Alan Greenspan, ex-Chairman of the Federal Reserve has become the latest high-profile individual to express serious doubts saying that default by Greece is “almost certain”. Sitting on one of the bigger dealing floors in the City earlier this week we were quite taken with the comment that “it’s more like a beer bottle that gets bigger every time you kick it down the road. Pretty soon it’s going to be a very large beer keg and when you kick it, you’ll break your foot”. The light hearted analogy will not be lost on the proponents of Game Theory in explaining the balance of power within Europe which goes against the conventional wisdom that the crisis has an economic solution. In the same way that if someone owes you a £100, it’s their problem - but if they owe you £100 billion, it’s your problem, Germany and France in particular are being held to ransom as the biggest holders of Greek debt both nationally and within their own banking institutions.

In the most recent deal between the European Union and the IMF, a new €12 billion payment to Greece was agreed in order to facilitate payment of Greek debt maturing in July. This loan was conditional upon a Greek backing for new austerity measures which look increasingly like hollow promises given the complete lack of Greek political unity. Indeed, George Papandreou is struggling even to unite his own party behind the need to implement difficult austerity measures and fiscal retrenchment. With virtually nothing in return, apart from preventing an immediate default, the bottle has been kicked down the road yet again.

Is Greece playing a clever game? Do they believe that the IMF, European Central Bank and EU will, between them always compromise to facilitate continued funding in order to prevent a default threatening the integrity of the Euro? This cycle would be a difficult trick to pull off but the alternatives may be simply too unpalatable for the rest of the Euro zone.

Only today Germany’s Angela Merkel a ferment supporter of the proposal to “re-profile” the terms of Greek bonds over a longer time frame without it being treated as a default (“extend and pretend?”) has softened her tone and seems more willing to compromise with the ECB.

The TAM investment team is watching events constantly during this period of uncertainty and stand by our decision to be, as far as practically prudent, out of the Euro for our Sterling based clients, with any direct European investments we do hold hedged back into Sterling

DOWNLOAD THE

June 2011 INVESTMENT NOTE

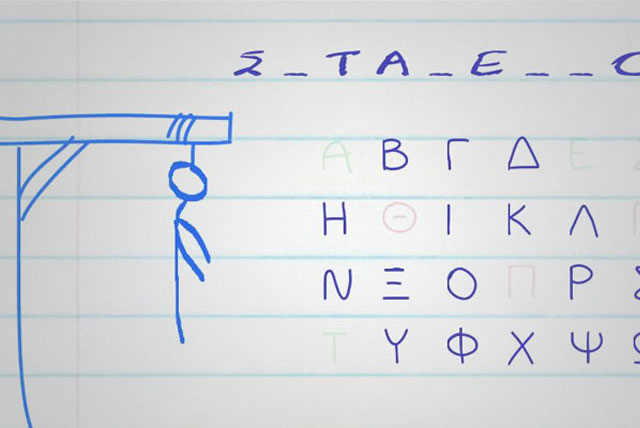

Greek Hangman

Greek Hangman

Risk On, Risk Off

A Time to Defend not Attack?