April 2024

Read the Full Note

THE SQUEEZE ON FEES

Are we now in a “race to the bottom” paradigm where DFMs are being pressured to slash fees to compete for assets whilst still offering value for clients? In this Market Insight we explain why we do not believe this is the case.

Read the Full Note

March 2024

Read the Full Note

INFLATION: STAYING DOWN OR RISING BACK UP?

Any movie watcher will know that well-trodden scene in which the hero puts the villain to the sword, turns around triumphantly only to see the same villain rising ominously behind them ready for action. In this Market Insight we discuss inflation and is it really under control?

Read the Full Note

February 2024

Read the Full Note

'YOU HAVE TO KNOW THE PAST TO UNDERSTAND THE PRESENT'

In the first three months alone, stock markets have already met or exceeded their targets for the entirety of 2024. Some will see this as a sell signal and others, a buy signal. Well, that’s what makes a market. In our Market Insight we take stock of an exciting start to the year.

Read the Full Note

January 2024

Read the Full Note

TAM Sharia: Where we've been and where we're going

2023 has drawn to a close and investors are beginning to open the bonnet of their portfolios to check which areas need tweaking.

Read the Full Note

December 2023

Read the Full Note

Sustainable investing: Another year older

Our Sustainable/ESG focused portfolios are another year older but are we as investors another year wiser? In this note we review the five important lessons learnt in throughout 2023.

Read the Full Note

December 2023

Read the Full Note

Hang on in there, the market is on the mend

2023 has largely been a year of lacklustre performance with just 7 behemoth tech stocks in the US delivering virtually all the market performance. Whilst investors have piled into these AI related investments there has been a lot more to get excited about. In this note we review the current landscape and some views for 2024.

Read the Full Note

November 2023

Read the Full Note

Soft Landing or Hard Landing? Take your pick but make sure you are in a plane that can handle both!

Stronger than expected economic data, resilient inflation and geopolitical tensions have all combined to unsettle investors. Fears now abound that the US Federal Reserve's prediction of interest rates remaining ‘higher for longer’ may actually morph into ‘higher for much, much longer’. Will the Fed be able to manage a soft landing for the economy or are we in for a far bumpier ride?

Read the Full Note

October 2023

Read the Full Note

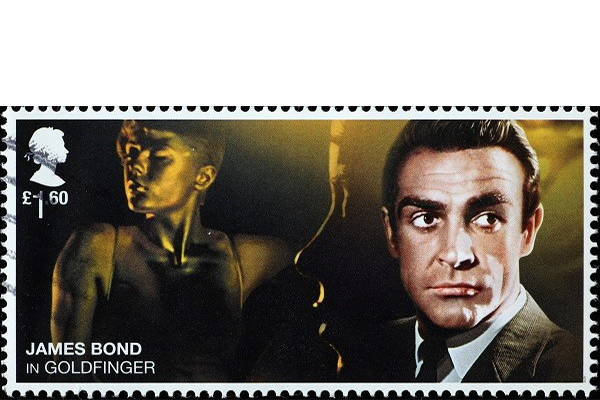

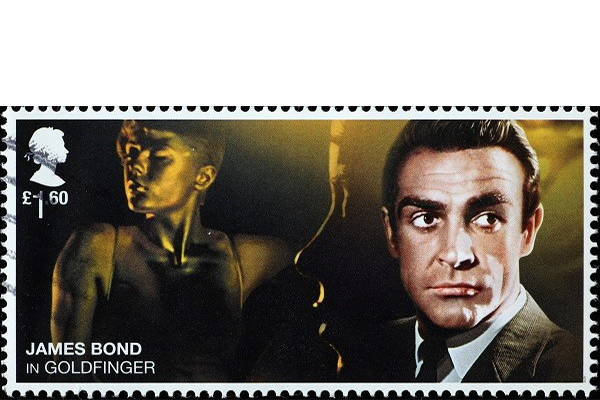

We meet again, Mr. Bond - Opportunity in fixed income

Last week, Fed Chairman Jerome Powell said that inflation is still too high despite easing slightly recently, and slower economic growth is likely needed for it to return to the central bank’s 2% target. This week we have had stronger US growth numbers, but weaker employment numbers. With rate decisions on a knife edge read how TAM are allocating to the fixed income markets.

Read the Full Note

September 2023

Read the Full Note

Artificial Intelligence (AI) Technology: World Changing or Ending?

AI has certainly become a household topic in 2023 and impacted many company and sector valuations. We discuss the issues and what we should be focusing on going forward.

Read the Full Note

June 2023

Read the Full Note

The risk of outperforming this market

Do strong stock market gains tell the whole story? James Penny discusses the story behind the story and concludes that its critical for clients to realise how important it is to spread investments over different scenarios, outcomes, and opportunities.

Read the Full Note

April 2023

Read the Full Note

FANGs bite back: A view on Q1

After a shocking 2022 for growth stocks, 2023’s Q1 market will go down in history as one of the most potent rallies in the history of growth investing. In this article we discuss the events that shaped the market and some thoughts for the remainder of the year.

Read the Full Note

April 2023

Read the Full Note

BUILDING THE NEXT BULL RUN IN 'GREEN' INVESTMENTS

We are now looking back on over a decade of artificially low interest rates put in place by developed country central banks, sparked by the financial crisis and a battle against deflation, thanks to China exporting low prices as globalisation took off. This period of easy money culminated in 2021 with unprecedented levels of monetary stimulus during the pandemic. There were suggestions that inflation was ‘dead’, amid an ‘everything rally’ where assets with little actual intrinsic value (such as speculative cryptocurrencies; non-fungible tokens (those strange pictures of apes if you remember); meme stocks; and a selection of profitless companies) were...

Read the Full Note

March 2023

Read the Full Note

Springing into Growth: the UK Budget

The past few years have been marked by political turbulence in the UK, ranging from ‘partygate’ scandals, to the proposed unfunded tax cuts which sent the UK economy into tailspin and Liz Truss packing after a shorter tenure than Ed Balls had on Strictly Come Dancing. However, since Rishi Sunak followed as Britain’s prime minister, there has been an air of control with no more hard-hitting headlines of political malfeasance or drastic calls for the removal of cabinet members. When Rishi took over the clear objective was to fix both Liz Truss’s and Kwasi Kwarteng’s large scale failure to sensibly...

Read the Full Note

March 2023

Read the Full Note

Banks: the winners and losers

Financial markets ended Friday in some turmoil, due to the dilemma over the strength of bank lending. In a rapidly appreciating interest rate environment, banks are usually the core winners as interest spreads and ongoing interest loan differentials cause bank profit margins to rise. Great news for banks which until Friday have been a core appreciating sector in markets globally. No mistake, rising interest rates are good for bank profits, until, that is, concerns about default rates - the ability of borrowers to cover interest payments or indeed repay loans - also begin to rise.

Read the Full Note