A brief history

TAM Asset Management International (TAM International) was established in 2004 to enable the International IFA market to offer their clients the award-winning model portfolio service provided by UK-based discretionary investment manager TAM Asset Management (TAM).

TAM’s origins trace back to the 1930s and the floor of the London Stock Exchange. From these early beginnings, they are now recognised as an institutional investment expert providing advisers and their clients with both onshore and offshore investment management solutions.

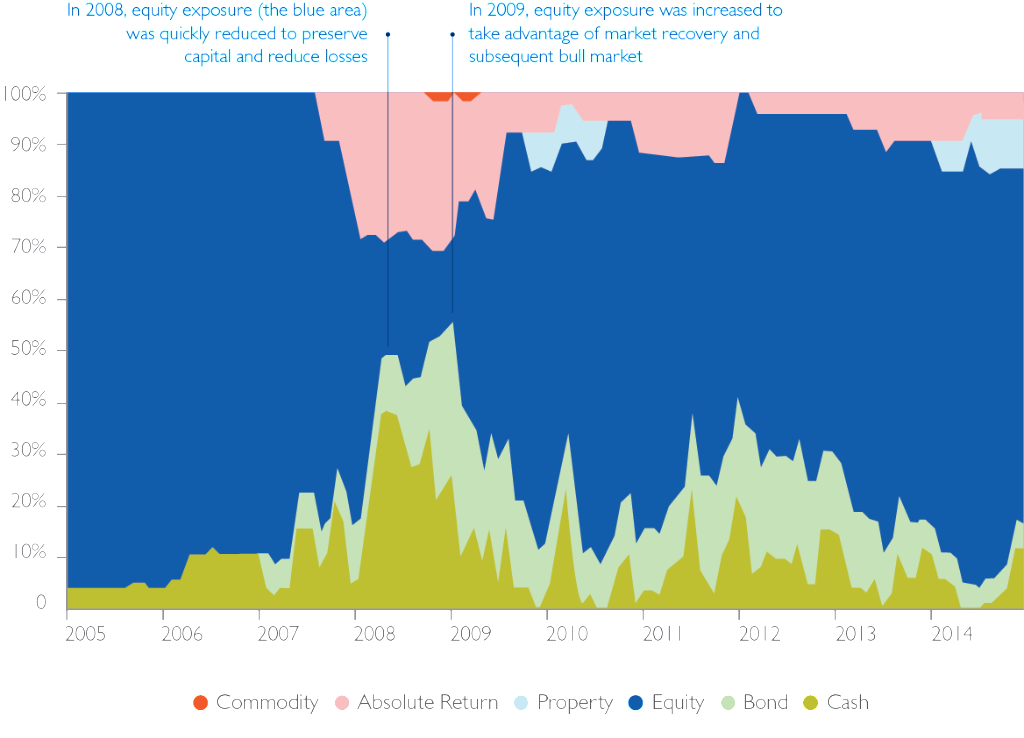

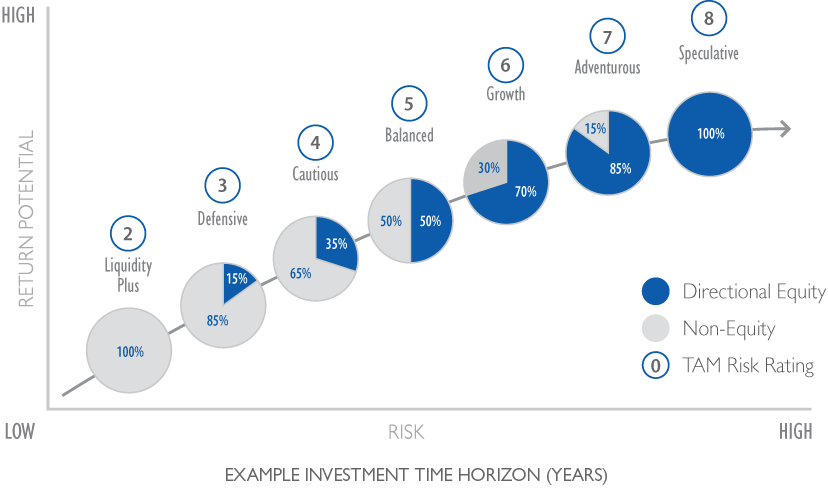

In 2007 TAM launched the risk-graded Active (previously Premier) model portfolio range, which was immediately tested during a market meltdown as they entered the sub-prime led ‘financial-crisis’. Their ethos from day one has been “to make money you mustn’t lose money” and place risk management and capital preservation at the core of all they do. These policies proved up to the task as clients incurred only minor losses during that period of unprecedented equity market decline and were able to benefit fully from the bull market that ensued.

In 2013 TAM were one of the first DFMs to launch the thematic Sustainable World (previously ESG) risk-graded model portfolio range to cater to those with specific sustainability-focused investment goals. Today, sustainability is a core component of the investment landscape and an essential requirement for a new generation of investors.

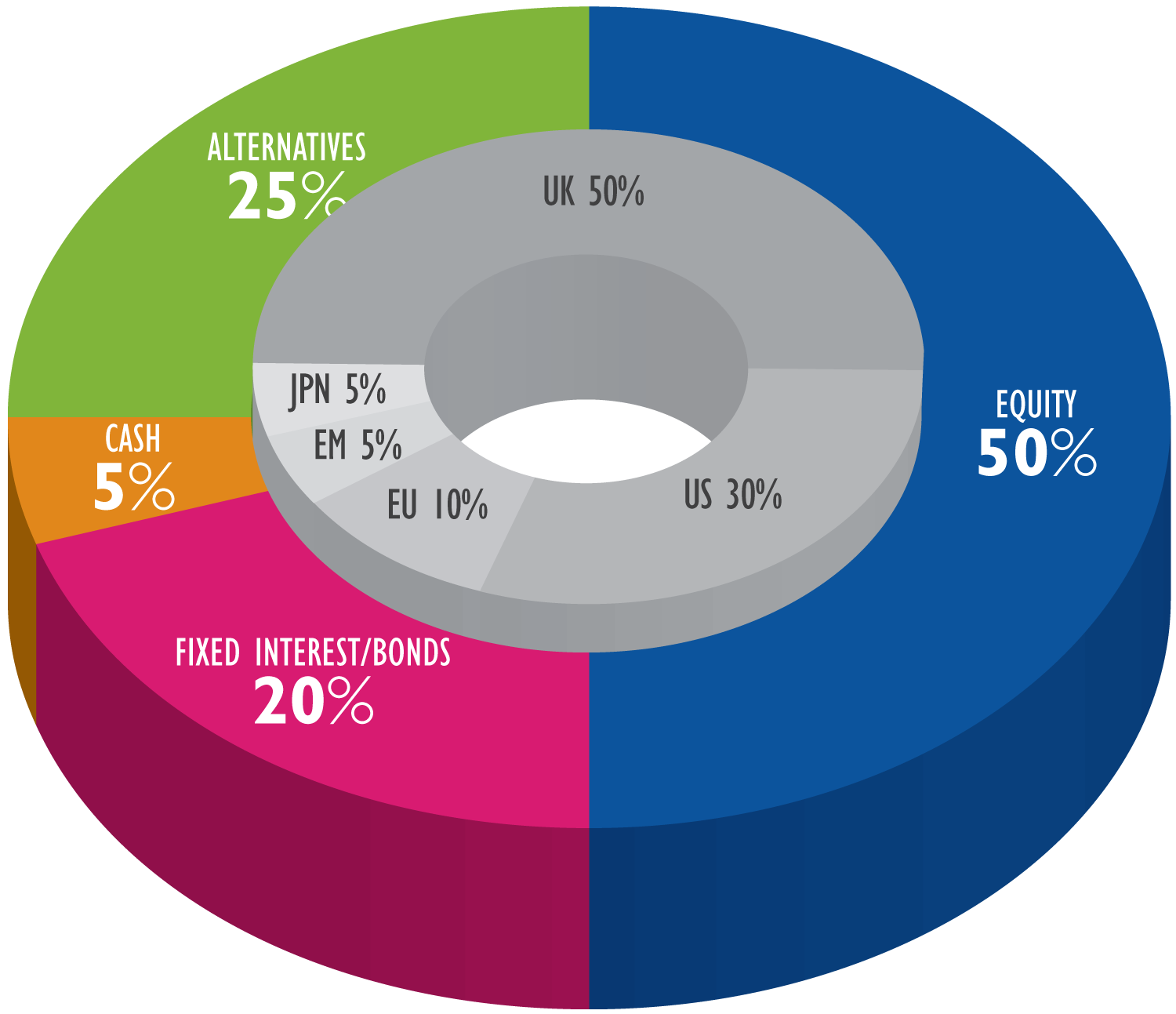

Today, TAM International, offers clients the choice of award winning model portfolios and custom-made solutions tailored to fit your personal situation and preferences.