The funds selected are expected to invest in shares of companies that:

- Only provide Islamic financial services, and no interest related services.

- Do not manufacture / sell products or services not approved by Sharia law - pork, liquors, tobacco, gambling, pornography etc.

- Do not have interest revenue exceeding a certain % of total revenue (usually 5%), unless it is given to charity.

The principles of Sharia are often considered slightly different by various Sharia fund managers we use. TAM therefore invest in funds that aim to be compliant with the principles of Islam. Any cash which forms part of the investment strategy is segregated and held on deposit with Al Ryan Bank who are approved by the Sharia Supervisory Committee. However, this is not always possible and cash may from time to time be held on deposit with Pershing Securities Limited, who are not compliant with Islamic investment requirements.

Risk management

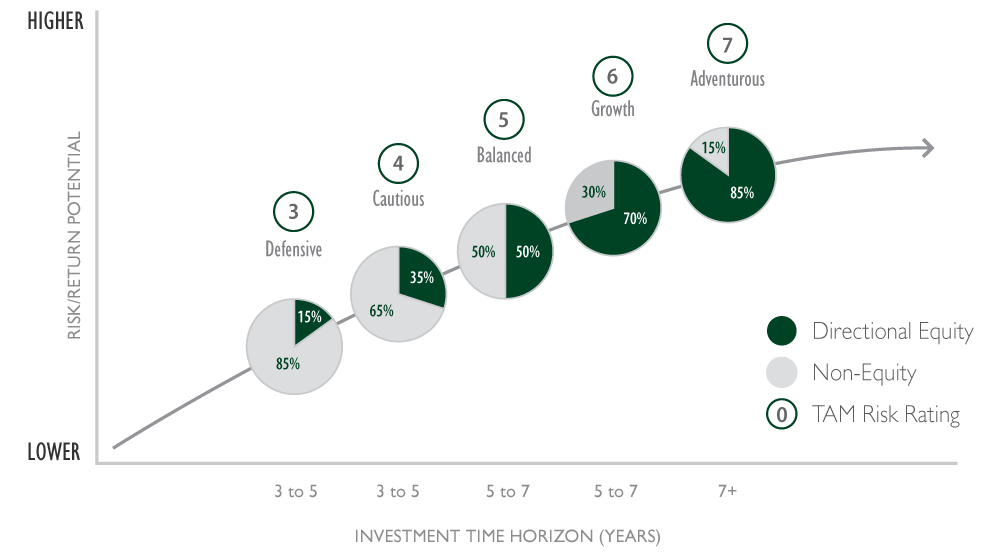

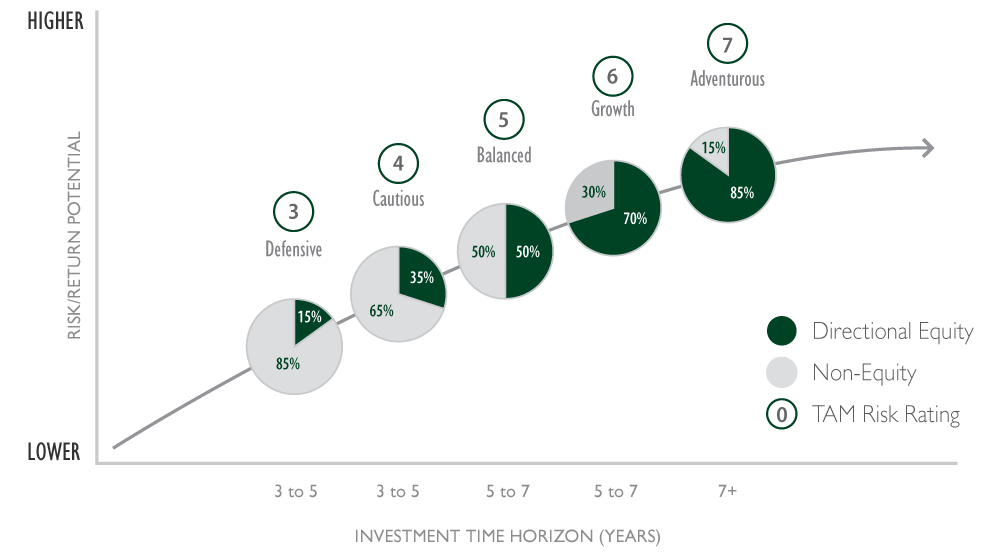

TAM Sharia clients have a choice of five risk profiled portfolios that span the risk spectrum from more defensive lower risk returns, through to more adventurous equity based investment returns.

Defensive

Sharia Defensive seeks to generate modest returns higher than cash in the bank over the medium term with potential for consistent though constrained capital growth. The portfolio has a more defensive approach to equity exposure compared to Sharia Cautious - typically comprising of 15% equity and 85% non-equity - though weightings may deviate within set parameters, allowing managers to react to market conditions.

Cautious

Sharia Cautious seeks to generate modest capital growth higher than bond-based returns over the short to medium term by employing a more cautious investment strategy than Sharia Balanced. The portfolio will have a modest approach to equity exposure - typically comprising of 35% equity and 65% non-equity - though weightings may deviate within set parameters, allowing our managers to react to market conditions.

Balanced

Sharia Balanced seeks to generate capital growth over the medium to longer term, with the aim of riding out short-term fluctuations in value. The portfolio will have a more balanced approach to equity exposure compared to Sharia Growth - typically comprising of 50% equity and 50% non-equity - though weightings may deviate within set parameters, allowing managers to react to market conditions.

Growth

Sharia Growth seeks to generate higher capital growth over the medium to long-term by employing a more dynamic investment strategy. The portfolio will have a higher exposure to equities compare to Sharia Balanced - typically comprising of 70% equity and 30% non-equity - though weightings may deviate within set parameters, allowing managers to react to market conditions.

Adventurous

Sharia Adventurous seeks to generate strong capital growth over the longer term and can experience frequent and higher levels of volatility than Sharia Growth. The portfolio will have a large exposure to equities - typically comprising of 85% equity and 15% non-equity - though weightings may deviate within set parameters, allowing managers to react to market conditions.

The diagram is for illustrative purposes only. The value of investments, and the income from it, may go down as well as up and may fall below the amount initially invested. Weightings may deviate from these levels at the Investment Team's discretion whilst staying within specific guidelines, so the above asset allocation is intended as a guide only.