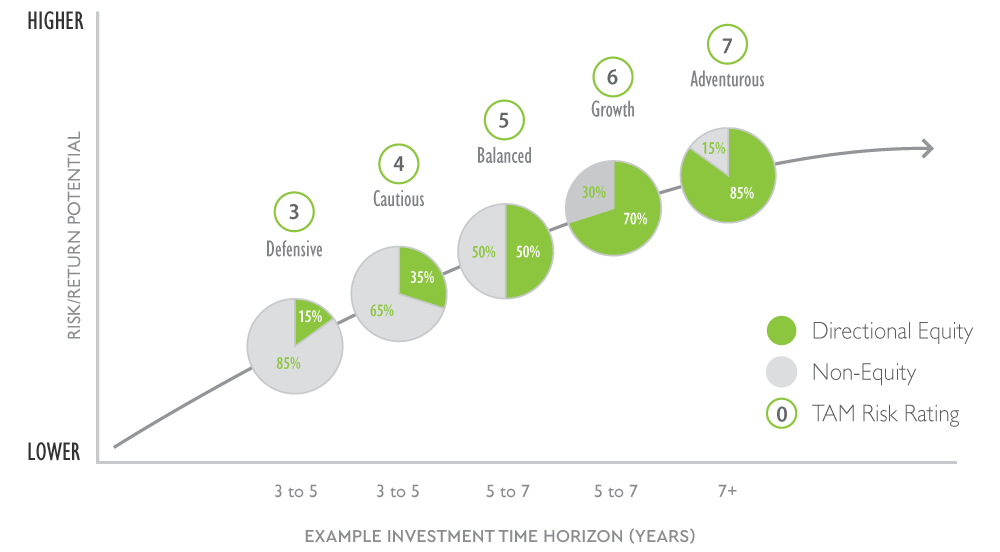

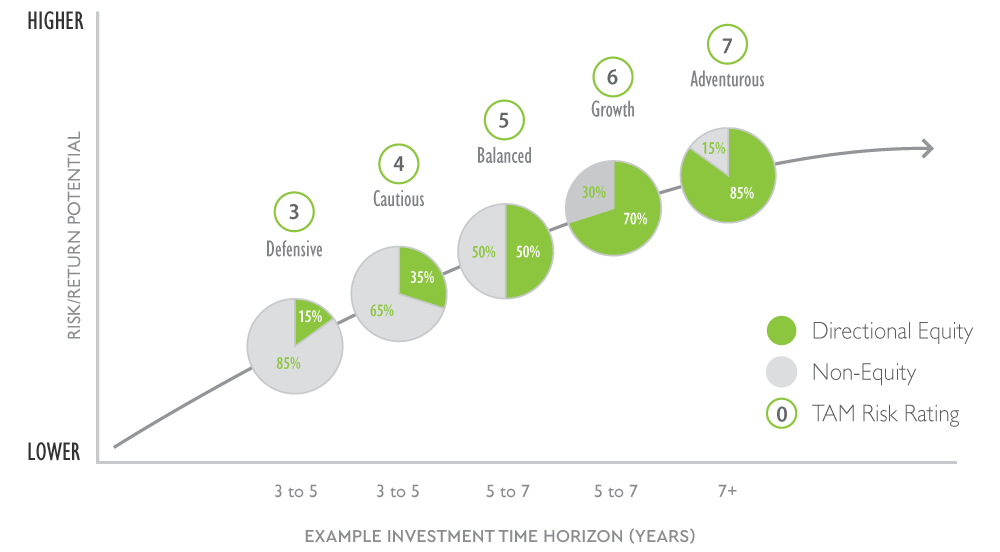

Defensive

Sustainable World Defensive seeks to generate modest returns higher than cash in the bank over the medium term with potential for consistent though constrained capital growth. The portfolio has a more defensive approach to equity exposure compared to Sustainable World Cautious - typically comprising of 15% equity and 85% non-equity - though weightings may deviate within set parameters, allowing our managers to react to market conditions.

Cautious

Sustainable World Cautious seeks to generate modest capital growth higher than bond based returns over the short to medium term by employing a more cautious investment strategy than Sustainable World Balanced. The portfolio will have a modest approach to equity exposure - typically comprising of 35% equity and 65% non-equity - though weightings may deviate within set parameters, allowing our managers to react to market conditions.

Balanced

Sustainable World Balanced seeks to generate capital growth over the medium to longer term, with the aim of riding out short term fluctuations in value. The portfolio will have a more balanced approach to equity exposure compared to Sustainable World Growth - typically comprising of 50% equity and 50% non-equity - though weightings may deviate within set parameters, allowing managers to react to market conditions.

Growth

Sustainable World Growth seeks to generate higher capital growth over the medium to long-term by employing a more dynamic investment strategy. The portfolio will have a higher exposure to equities compared to Sustainable World Balanced - typically comprising of 70% equity and 30% non-equity - though weightings may deviate within set parameters, allowing managers to react to market conditions.

Adventurous

Sustainable World Adventurous seeks to generate strong capital growth over the longer term and can experience frequent and higher levels of volatility than Sustainable World Growth. The portfolio will have a large exposure to equities - typically comprising of 85% equity and 15% non-equity - though weightings may deviate within set parameters, allowing managers to react to market conditions.

The diagram is for illustrative purposes only. The value of investments, and the income from it, may go down as well as up and may fall below the amount initially invested. Weightings may deviate from these levels at the Investment Team's discretion whilst staying within specific guidelines, so the above asset allocation is intended as a guide only.