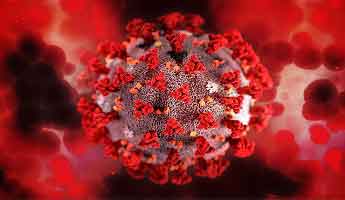

The emergence of a new variant of Coronavirus has caused a risk off move in global equities today as the prospect of a vaccine immune strain causes markets to reassess risk sentiment. Whilst news is just emerging of the variant from South Africa, there are concerns that it may be resistant to vaccines and general immunity and could further the need to lock down economies. The UK and Europe opened sharply lower, with losses in the 2% to 3% region in flagship, large company indexes, whilst government debt, seen as a safe haven in times of market stress, was being bought and was up over 1% in the UK. Gold was also being bought to reinforce defensive elements of portfolios, rising over 1%, whilst commodities such as oil were down as much as 5% as the prospect of potential shocks to travel and general consumption rose higher. Whilst the moves may be seen as a knee jerk reaction to early stage news, the reaction highlights how all time markets can see short term set backs.

Powell reappointed as FED chair

Ambiguous US Jobs Report Shows Growth Slump