FOR SALE: 5th Largest US Investment Bank, priced to sell.

Do the Weekends events mark the beginning of the end of the credit crisis or merely the beginning?

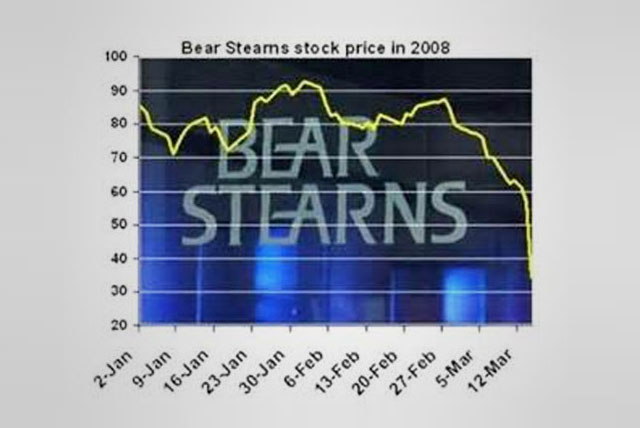

The US-led credit crisis claimed it latest victim last week; Bear Stearns, the 5th largest investment bank in the US announced on Friday that it had secured emergency financing from the US Federal Reserve Bank of New York and JP Morgan Chase. The announcement sent the banks share price into a tail spin and sent both lenders and investors running exaggerating the funding problems the bank has sought sort to relive. Then In an unprecedented move over the weekend, the Federal Reserve brokered a fire-side sale of the essentially bankrupt bank to JP Morgan at knock-down price of £236m (or $2 a share). This values the bank at less that a quarter of the market value of it’s headquarter building. Since January 2007 the banks share price has fallen from nearly $17 to $30 as of Fridays Close, to the $2 JP Morgan paid; a drop of 98.8%! It is clear that this price reflect the liability JP Morgan view the Bear Stearns asset as, and tells you that the market greatly underestimated the risk associated with holding leveraged securities backed by mortgages. Indeed the bank has at least $16billion exposure to commercial mortgage backed securities assets and $15billion exposure to prime Alt-A mortgages – mortgages given to people with relatively high credit scores but who can’t document their income, plus $2billion exposure to sub-prime.

To support the deal the US Federal Reserve will provide special financing to JP Morgan and agreed to fund up to $30 billion of Bear’s less liquid assets. And in acknowledgement of the serious nature of this development, the Fed additionally cut its discount rate (not to be confused with the Federal Funds rate) by 0.25%. This only two days before their regular meeting where they are expected to cut rates by between a 0.5% and 1.00%.

More Pain to Follow?

In short, Yes. There mere fact that such a bank could fail in such spectacular fashion and in such quick time highlights the issues institutions when evaluating their liabilities. Unfortunately when investor confidence falls, as now, and they turn their bank on illiquid and leveraged debt instruments, further financial institutions may suffer a similar fate to Bear Stearns. But rather than only reflecting on the pain caused to share holders of Bear Stearns we must look at the wider picture. If Bear had been forced to liquidate all their positions the knock-on effect may well have destabilized the whole financial system. This is the only reason the Federal Reserve felt compelled to intervene.

Will tomorrow’s inevitable interest rate cut mark the end of the crisis? Commodities are soaring as safe haven investments and a hedge against the falling the dollar, the dollar has fallen to record lows against the euro as investors abandon dollar denominated assets. A further rate cut, even 1.0% cut, will do little to apiece the situation. The problem is it's moved from a credit crisis to a crisis of confidence – as difficult as it is to correct a credit crisis, it's even tougher to address a crisis of confidence.

DOWNLOAD THE

March 2008 INVESTMENT NOTE

Bear Stearns

Bear Stearns

Catch a Falling Knife

UK Inflation