Do economic fundamentals support equity valuations?

The recent equity market rally has come as a welcome relief for many investors. Since hitting lows in mid-March the UK stock market (represented by the FTSE 100 index) has roared over 45%, with a similar pattern repeated across the globe. Many attribute this rise to improving economic fundamentals, whilst others simply to liquidity; too many side-lined investors chasing the market up and maintaining the momentum; interestingly both are true.

Positively net investors’ inflows in to investment funds clearly increased as the year progressed (indeed 2009 may prove a record year) and some important economic indicators are certainly showing signs of improvement; unfortunately some are not. The decline in GDP growth seems to have bottomed (although the UK is still technically in recession) and the pace of growing unemployment has slowed (although it is still at ten year highs!). Worryingly the liquidity that is returning to the corporate credit markets has not yet filtered through to the consumer credit markets with significant falls in the level of secured and unsecured lending this summer. A revival in retail spending (including cars and housing) will be a vital component to sustaining any recovery. Equity valuations have reached multiples last seen pre-Lehman brothers, optimistically factoring a sustained economic recovery and improvement in corporate earnings. Should these earnings improvement not materialise valuations could tumble very quickly.

This is where the debate now centres; have the equity markets disconnected from economic fundamentals and more relevantly will they be pressured should new money inflows fall? Certainly further weakness in the labour markets and housing sectors could incite a double-dip recession but thankfully we consider this unlikely.

We continue to stand by our prediction that the recovery in growth will be slow and occasionally painful. The Bank of England will maintain an accommodative policy well into next year; to both stimulate growth and inflation (Inflation will certainly reduce their government debt burden) and may well have to extend their current quantitative easing programme. This environment of slow growth and accommodative monetary policy will support equity valuations and generate a gradually re-rating of corporate earnings expectations. Unfortunately volatility has notability increased over recent weeks and it would be naive not to expect a short-term pull back in equity markets before year end.

DOWNLOAD THE

October 2009 INVESTMENT NOTE

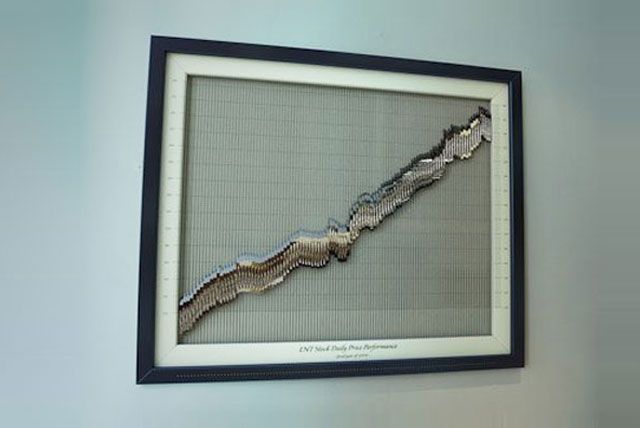

Pictures Can Tell a Thousand Words

Pictures Can Tell a Thousand Words

A Weaker Dollar

Is the Party Over?