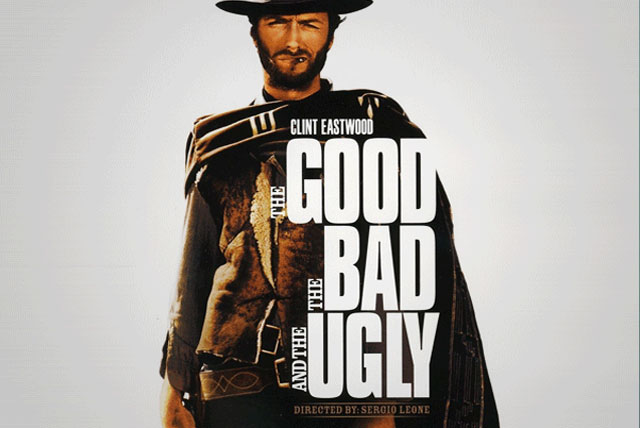

The Good, the Bad and the Northern Rock!

The UK Banking sector bore the brunt of the credit crisis with a number of long-standing high-street names being nationalised. However a minority, including HSBC and Barclays, resisted the temptation of participating in the government bail-out plan, a decision which now seems to be reaping rewards though at the possible cost of vilification. In this note we surmise who are the Good Banks, the bad banks and the Northern Rocks!

HSBC announced a 57% drop in first half profits on an impairment charge of £13.9 billion, (a throwback to the takeover of US subprime lender Household International in 2003) though investment banking revenue more than doubled. Barclays recently reported a 10% increase in net earnings, with loan impairment of £4.6 billion in the first half of the year. Standard Chartered reported net profit rose to $1.9bn and a 10% dividend hike, though also announced a £1 billion fund-raising. RBS 70% state-owned, still suffering from the now unanimously denounced takeover of ABN-Amro. Lloyds, 43% state-controlled following £17 billion in government bailout funds after acquiring HBOS in January this year, took a £13 billion impairment charge on bad loans (mostly old HSBC property loans in UK). And finally Northern Rock which announced 1 £770 net loss in the first half after loan impairments of £602 million (not too much compared with the £14.5 billion it owes the government). Additionally it announced that 12,000 borrowers with 125% mortgages were now in arrears hints at the problems to come.

In summary the death knell for the UK banking sector has passed; as economic activity stabilises banking profits will increase. Those banks that are still 100% privately owned will be freer to capitalise on any improvement, attract the brightest talent and increase investment banking revenues. Those exposed outside the UK (particularly Asia) will benefit, and those with the least consumer lending will equally prosper. The TAM pick, standard charter, with Barclays and HSBC a close second.

DOWNLOAD THE

August 2009 INVESTMENT NOTE

UK Banking Sector

UK Banking Sector

Absolute Return Equity Funds

Equity Market Rally