Is the Tragedy in Japan a Tragedy for Global Financial markets?

The Japanese markets were hit hard early Monday morning, with the Nikkei trading sharply lower around the 9,600 level, down 6%, triggered by a panic sell off by investors fearing a slowdown in the Japanese economy following the deadly earthquake. The rest of the markets around the Globe, at this point, seem to have absorbed this bad news and are for the most part trading normally. Though Japan will struggle to recover from this strongest earthquake, we do not expect this to derail the world’s economy and believe the $183 billion injected by the Japanese central bank into its economy will be able to keep its financial system stable.

Some members of the TAM investment team remember well the devastation of the Japanese earthquake in Kobe in 1995. As managers of significant investments in Japan, our job back then, as now, was to attempt to quantify the financial impact on the economy and likely consequences for the stock market. Some of us saw, first hand, the area and met the management of companies that would ultimately be central to the rebuilding of the city. The estimated cost of rebuilding of Kobe then was around $100 billion. And rebuilt it was, although it never recaptured its position as one of the world’s busiest ports.

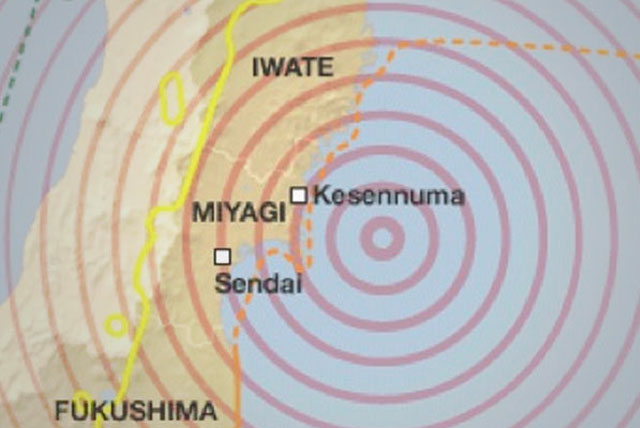

We now know that this is an unparalleled natural tragedy combining an 8.9 magnitude earthquake, the most powerful in the history of Japan, strong after-shocks and catastrophic damage from the resulting tsunami. Estimates of the cost of the disaster appear to be a loss of life running into the tens of thousands and an initial financial cost of an estimated $15 billion which is probably far too low an estimate. On top of this, explosions at two of the Fukushima nuclear plants has introduced a further layer of uncertainty and this itself has become the main focus of worry for Tokyo residents with some choosing to relocate their families to cities in the west and south of the country for fear of radiation leaks. However, most Tokyo residents appear determined to carry on life as normally as possible, notwithstanding a series of rolling power cuts, and it was announced as early as Saturday that the Tokyo stock market would open as usual on Monday morning. For those familiar with Japan, this is unsurprising since Tokyo itself sits atop a confluence of tectonic plates and significant earthquakes are commonplace. Japanese people are taught from an early age that earthquakes are a reality of daily life and many foreign visitors have experienced small quakes which they are then surprised to see do not even make the daily news. The biggest worry for everyone is the outcome of the nuclear power station containment efforts, not the earthquake.

The Bank of Japan held a policy meeting on Monday and will be keen to ensure stability in markets. To this end, the BoJ has injected a record amount of $183 billion into money markets as the equity market fell and credit risk rose sharply. However, as expected, many companies in the construction sector were bought up to very high levels, in some cases by their market-imposed daily limit with volume severely restricted; a rule that’s been in place for many years. MHI, for example has a market capitalisation of £27 billion with world leading capabilities in shipbuilding, engineering infrastructure and power plant technology including nuclear power stations that are second to none. Their share price, as many like it, are stable as order books for companies in this sector will likely be full for the decade to come.

More short term disruptions are slightly more difficult to read. Toyota, for example, shut down production at its main assembly plants to assess damage. Of course, Toyota is truly global company and many other companies that make up the Nikkei 225 index have export ratios far bigger than their own domestic markets. Canon has an export ratio in excess of 80%. The impact for many of the global Japanese firms may be more limited that their share price performance suggests.

What is likely in the short term is that Japan experiences a slowdown in economic activity, which was already flat, into a technical recession. Assuming no further escalation in the disaster, the extent to which this is factored into the stock market already will depend largely on the reaction of the Japanese Government. Without a doubt, the authorities will stand full behind the substantial rebuilding of major infrastructure. They will rely heavily on the expertise of their industrial base and the resourcefulness and determination of their people. It is possible that the Government may see it both timely and necessary to raise consumption tax (the equivalent of VAT). This has been held low for many years to help the demand side of the economy get some traction. Such a rise, in the circumstances, may be justified but the reaction to it is difficult to forecast.

It is also likely that the bond market will fall, raising longer term interest rates. If the Bank of Japan holds base rates close to zero, the yield curve will steepen. Paradoxically, this forced return to a more normal financial profile may end up benefitting the Banks assuming there is sufficient economic activity for them to back. Prior to the disaster, this scenario may have emerged given a few more years of recovery. It will be painful for the insurance sector which, in the first instance, has been hit hard in the stock markets – in some cases unfairly. Tokio Fire & Marine, for example, say that their commercial exposure is less than 2% of their NAV. However, the latest industry estimates for losses are up to £22 billion. Ultimately, many losses will flow through to impact earnings at European insurers and Lloyds of London some of whom are already dealing with losses in Australia and New Zealand.

Japan is first and foremost an industrialised economy and the long term correlation of its stock market to industrial production has rarely broken down. Furthermore, contrary to popular perception, a strong Yen has also coincided with stock market strength – the technology boom of the late 90’s notwithstanding. However, it is not unusual for the Japanese stock market to overshoot on the downside during volatile and uncertain times. Economically speaking, and from a valuation standpoint, we believe that the market is already oversold but we recognise it could move lower in the short term, particularly if nuclear uncertainties persist. We believe we are right to be invested in Japanese equities for the longer term.

The biggest concern is the unfolding situation at the Fukushima nuclear power station which the investment team is monitoring constantly. Currently, our view is that selling out of Japan on a purely precautionary basis is just a little premature. In our opinion the US economy is still the engine for global growth and the distressing events unfolding in Japan we see as a short term negative on this rekindling of global economic growth but no more.

Our picture needs some explanation as it depicts the Japanese nation in adversity:

The Wave (The Great Wave Off Kanagawa), Katsushika Hokusai, c.1830.

The Wave is the most famous of a series of works called the Thirty-Six Views Of Mount Fuji. This unique style of work, from a wood block print, depicts what at first appears to be a calamitous and hopeless situation. However, closer inspection reveals a more balanced and deeper meaning to Japanese. The distinctive style is drawn with mostly unbroken lines, features Mount Fuji, a reverential icon in Japan in the background. Geographically speaking, it is a perfectly shaped volcanic cone viewed from any angle. The subtle curve of the mountainside is repeated again in the hulls of the fishermen's boats, the sea and the big wave itself; visually drawing together a similar theme to the plight of the fishermen (the people) caught between hope and fear, security and despair. Whilst the wave threatens to obscure the view of the mountain it remains wholly visible as a symbol of hope and safety. The unbroken line style of the artist is broken only at the tips of the breaking wave. All is not yet lost. This picture adorns the walls of almost every student’s home in Japan as stands as an example of the stoic and robust nature that characterises the Japanese people. One should not underestimate the ability of Japan to gather up the country’s resources as it begins to process of repair.

DOWNLOAD THE

March 2011 INVESTMENT NOTE

Earthquake in Japan

Earthquake in Japan

Oil Shocks & Inflation

Risk On, Risk Off