December 2011

Read the Full Note

Retrospective 2011

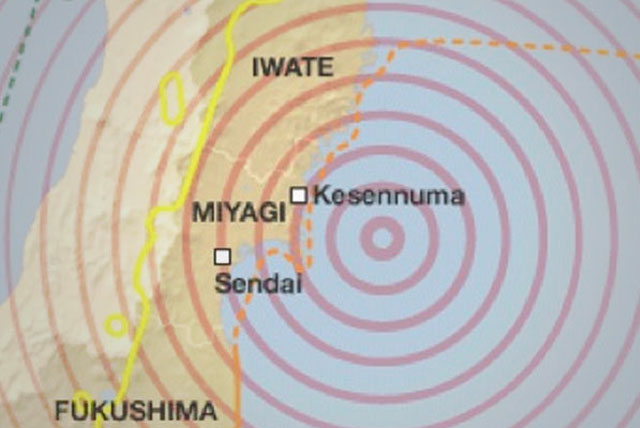

In this note we review our thoughts and predictions we made at the beginning of 2011. For all intent and purposes 2011 was looking to be another year of recovery for global economies and the financial markets. How wrong this was. The optimism enjoyed in the first months of the year evaporated quickly as global economies were battered by civil unrest in North Africa, a Japanese earthquake of nuclear proportions and the developing crisis in Europe.

Read the Full Note

August 2011

Read the Full Note

A Time to Defend not Attack?

As “Short” Traders Make Hay Whilst the Sun Shines? It is difficult to point to a single event that triggered this move towards safe haven assets causing equity markets and bond yields to fall to their lowest levels of the year. Indeed much of the bad economic and geopolitical news has been in the public domains for weeks if not months! Debt issues in the US and the Euro zone are well documented and so is the inability of our central bankers and politicians to effect any meaningful (and long lasting) solutions!

Read the Full Note

March 2011

Read the Full Note

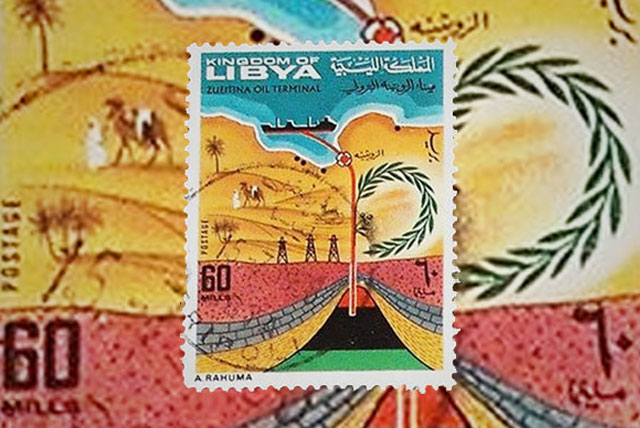

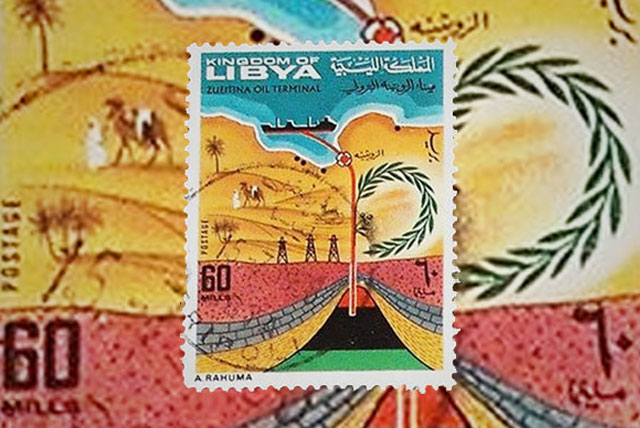

Oil Shocks & Inflation

Directionless markets focus on short term news. A glance at the chart of any of the major global equity markets reveals that equities have barely moved a step since the beginning of February, around the time when events in Egypt began to escalate. Since then geopolitical events and natural disasters have seen equity markets develop into a saw-edged pattern reflecting very short term “risk on, risk off” trading with no real direction.

Read the Full Note

January 2011

Read the Full Note

A Review of our 2010 Outlook

In this note we review our thoughts and predictions we made at the beginning of 2010. At the beginning of 2010 many were still shell shocked from the rollercoaster ride that was 2009 but some investors, including us, predicted a profitable investment year for 2010. Indeed we believed that the 2010 would mark the beginning of a new era of opportunity for investors, an era that would not take its cues from the ‘lost decade’ we had just witnessed but one that would see the beginnings of solid longer term growth.

Read the Full Note